Learn more about eHopper POS tax management.

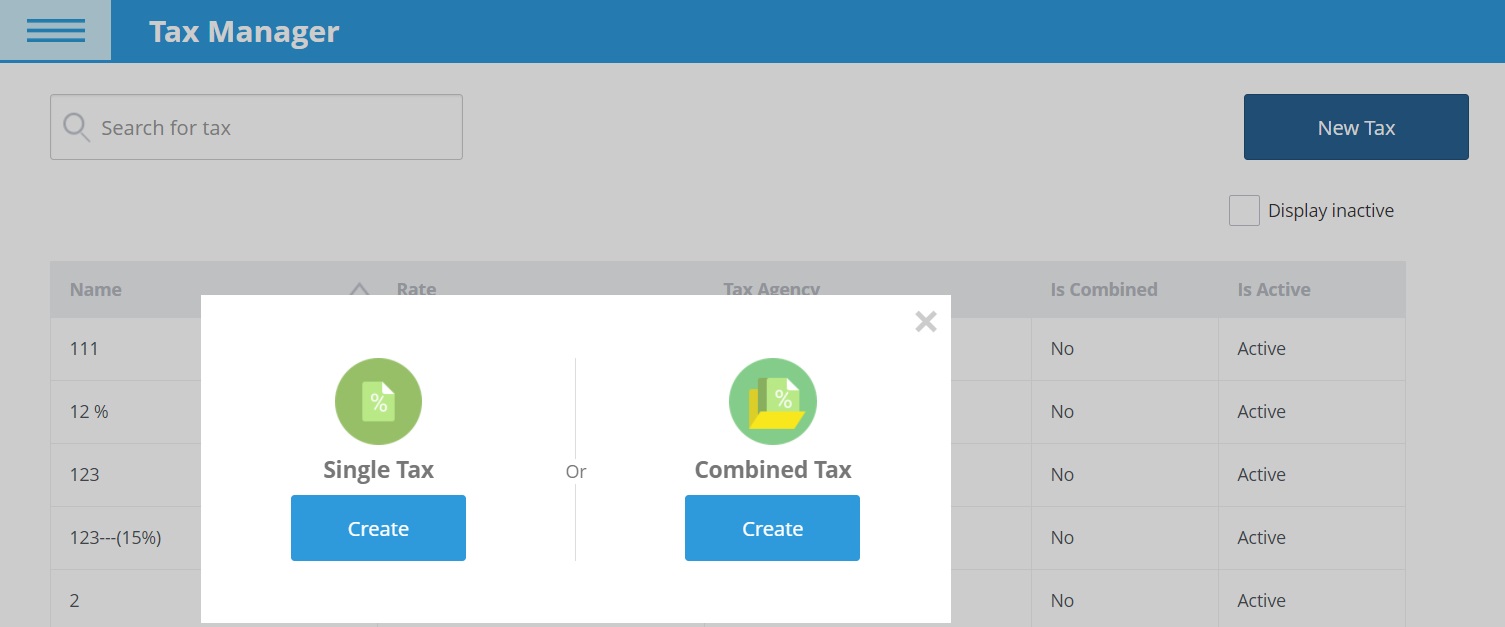

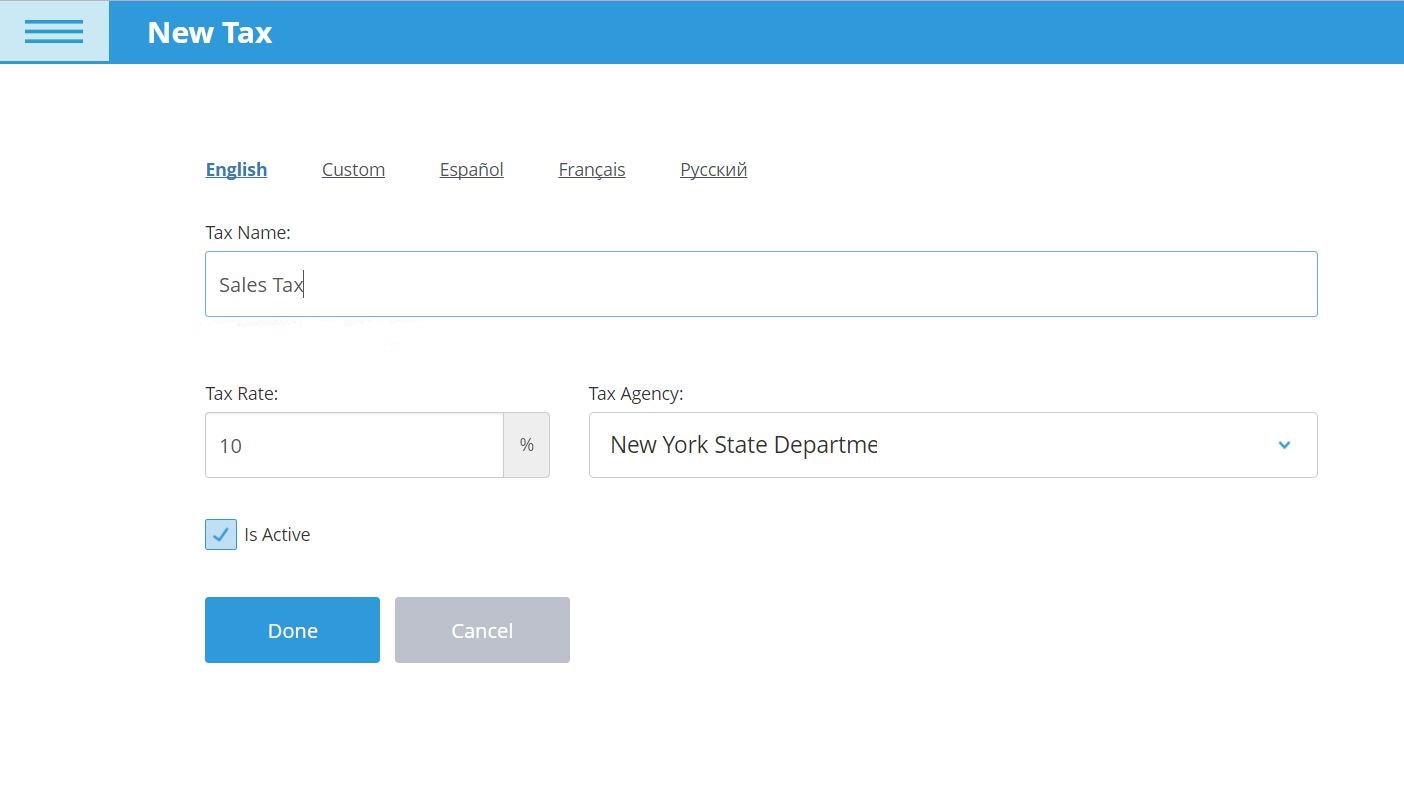

Manage Individual or Multi-line Taxes

Reduce human error and increase efficiency by assigning either an individual or multi-line tax to one or multiple stores or products, which will be added by default.

- Select the rate for each tax

- Combine taxes to make up a single multi-line tax

- Assign a tax to one or multiple stores

- Assign a tax to a specific product

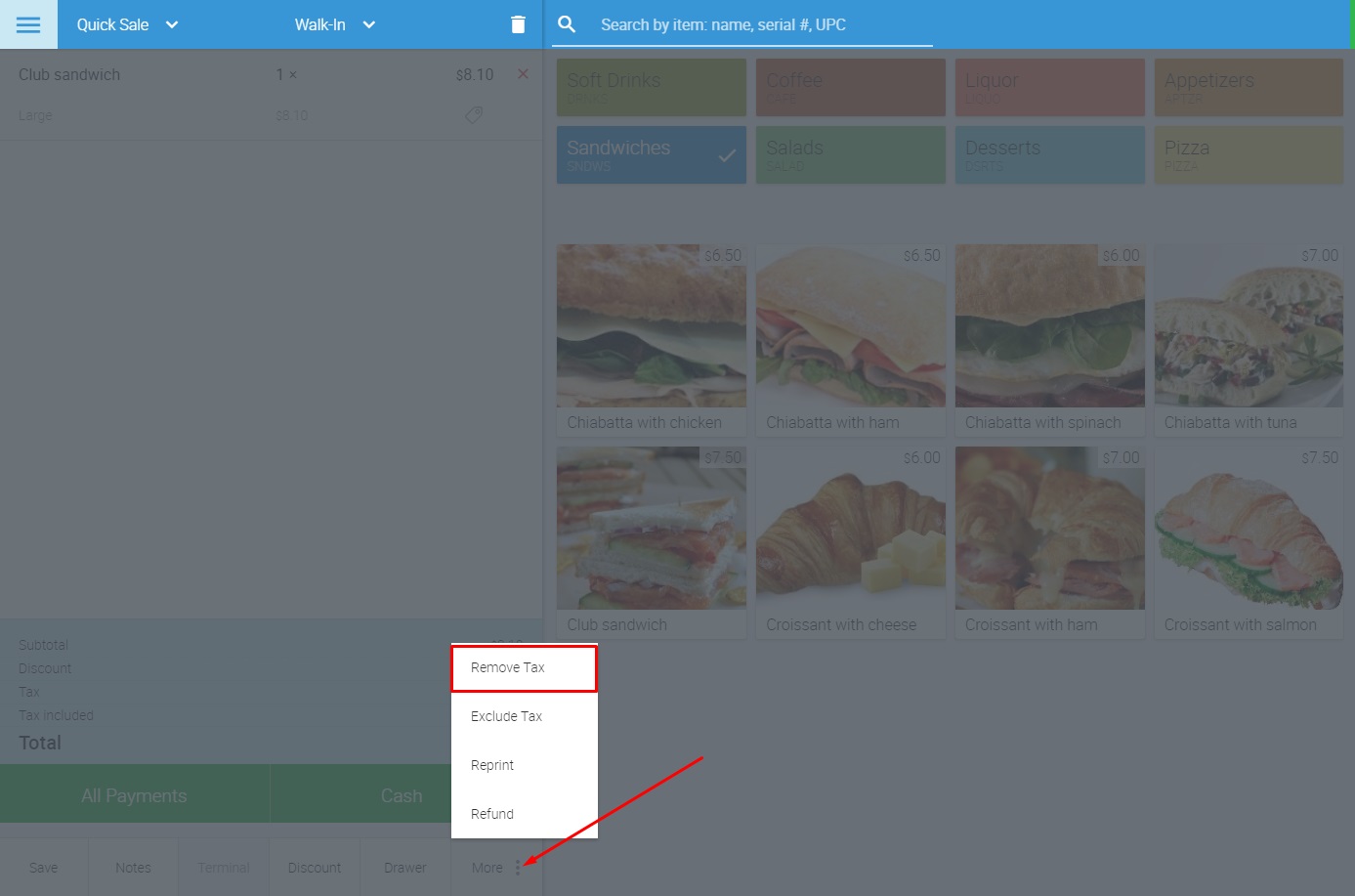

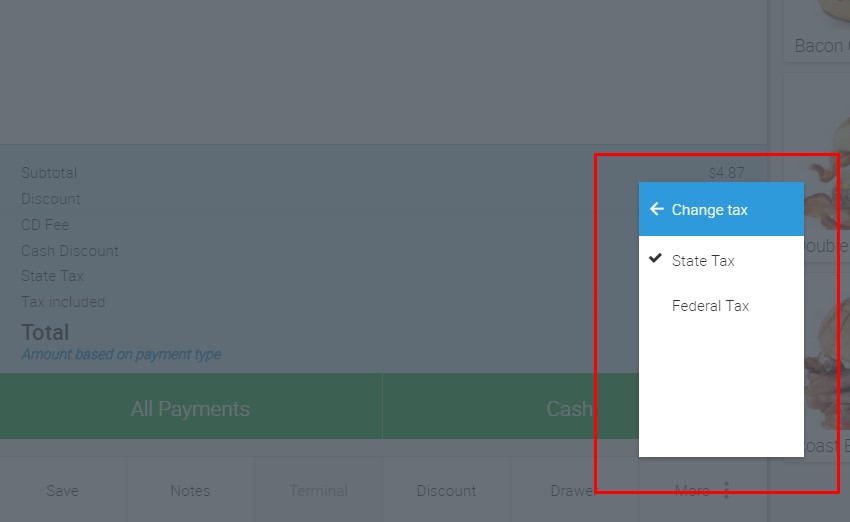

- Choose to change or exclude a tax before each transaction

- View amount totals for each tax while processing orders

- Analyze tax reporting, including total amount collected for each tax

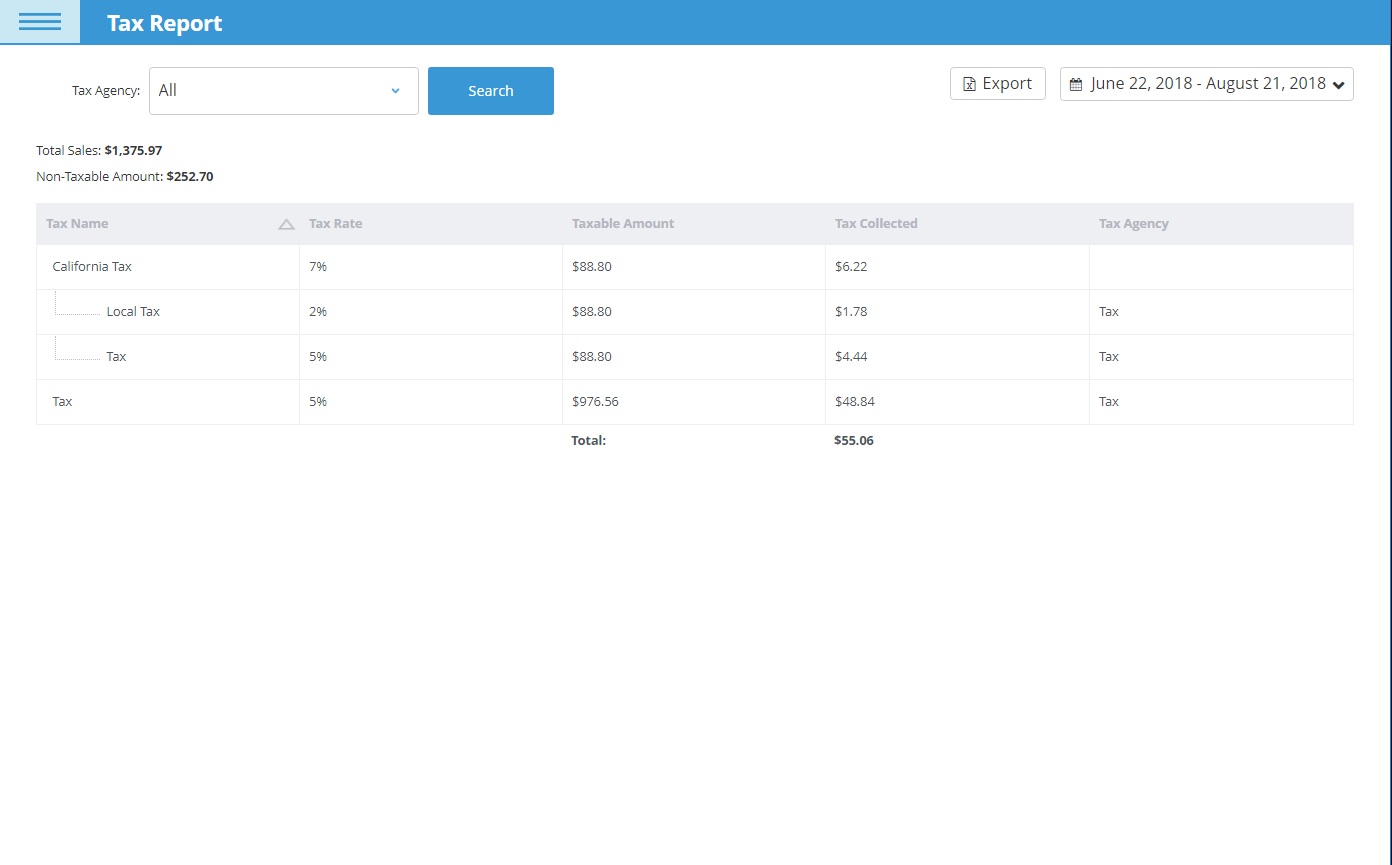

Tax Report

Be more organized with your tax data to avoid headaches with the IRS and increase knowledge about net income with the Tax Report.

- Analyze info on all taxes paid during transactions for a selected time period.

- Filter tax info by store and tax agency

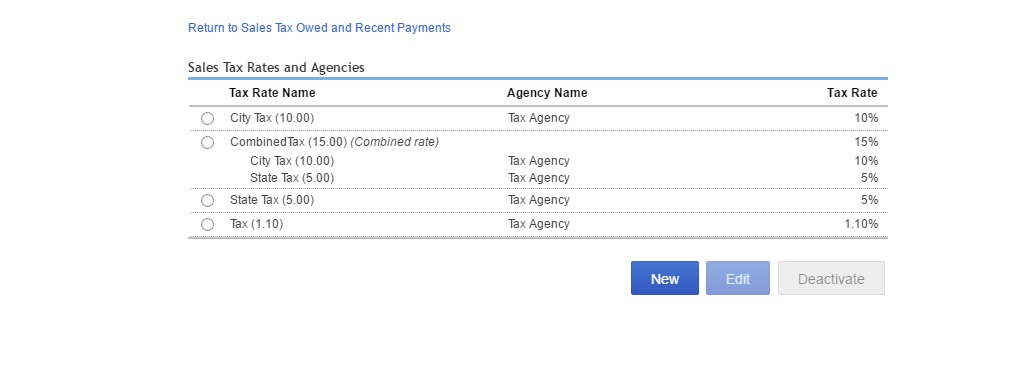

- View list of all taxes and their tax rates, including combined taxes

- Compare taxable amount to non-taxable amount for each tax

- View the total dollar amount of taxes collected for each tax and for all taxes added together

Still have questions?

Call 212–651–8911