How to Setup and Use QuickBooks Online with eHopper POS

Proper accounting is a necessity of any business. Without it, it is impossible to assess the current health and growth of the company accurately.

These are important factors towards determining if an organization is heading in the right direction. And, if that business or restaurant is not on the right track, what can be done to fix that negative trajectory.

Thus, not only does accurate accounting assess the status of a company, but it is also a valuable tool for evaluating the returns on investments and how to properly manage spending to obtain the biggest potential gain. For a company to grow, it must invest in new strategies, technology, locations, etc.

Arguably, proper accounting is more critical for a small to medium sized business because these organizations have far less room for error. Whereas a larger firm can stomach a bad investment or a poor quarter, a similar mishap for a small business could easily mean disaster because they often lack the budget and cash reserves to bounce back from a significant loss.

Accounting is truly a multi-faceted area of expertise that carries a number of upsides. Aside from the above benefits, it can also help a business:

- Price goods and services correctly

- Determine the ROI of certain tactics like a big sale or marketing campaign

- Ensure money isn’t lost/stolen by employees, customers, suppliers, etc.

- Protect against fraud (is that deal really as good as they make it sound?)

- Breeze through any tax audits

- If it comes to it, sell your business at the right time and for the right price

However, finding a solution for your accounting needs can be a challenge, especially for a budding entrepreneur that wants to save as much money as possible. It might not be in your budget to hire a professional accountant.

But, trying to handle the accounting responsibilities on your own, without the right tools, can not only be time-consuming but quickly lead to reporting errors that could have damaging consequences.

That’s why so many retail businesses and quick service restaurants turn to Intuit QuickBooks. In fact, QuickBooks has almost 30 million small business using this accounting software to help manage and grow their businesses.

They dominate the industry with an 80% market share. Despite the many other accounting software and solutions popping up in the Digital Age, QuickBooks remains well ahead of any competitor.

What is QuickBooks Online

QuickBooks Online is a cloud-based accounting software platform produced by Intuit. QuickBooks tools have always been geared towards smaller businesses and restaurants that need on-site accounting help, but don’t have the budget to hire an in-house accountant.

The software is capable of several different critical accounting functions, like paying bills, managing payroll, tracking investments and much more (we’ll get into these a little later).

Traditionally, Quickbooks was desktop software, but Intuit has begun to change their efforts to meet the dynamic nature of today’s predominantly online world.

Thus, we have Quickbooks Online. While the company still does offer the desktop versions (Quickbooks Desktop Accountant or Desktop Enterprise), they have been encouraging users to turn to an online solution and haven’t been putting the same level of features and updates into their desktop offerings anymore.

If you’re familiar with QuickBooks’ desktop software, you’ll be happy to discover that QuickBooks Online has most of the same features — most, but not all. Even though Intuit is pushing for users to turn to their online tools, the desktop software is actually a more robust accounting program.

That said, Intuit is not only bringing these features to their cloud-based tool, but it is also worth mentioning that many of the seemingly missing features are handled by free, third-party services.

Key QuickBooks Online Features and Benefits

As noted above, QuickBooks Online offers a lot of the accounting tools that have come to be expected of a QuickBooks program. For this discussion, we will focus on the features that set QuickBooks Online apart from any of the other Intuit products, particularly any QuickBook Desktop programs.

Before getting into the specific features, it is worth mentioning the benefits that come simply from being a cloud-based service. In the Digital Age, speed and accessibility are crucial. A cloud-based accounting solution allows a business or restaurants owner to access their financial data via a mobile device from anywhere.

It also requires less in terms of processing power and storage capacity. Best of all, everything is automatically backed up, so you’ll never lose important accounting data or documents.

Now, the major features that set QuickBooks Online apart from other solutions like QuickBooks Desktop:

- Schedule automatic payments, send payment requests and monitor transactions from anywhere your mobile device has a connection

- Distinguish payments (such as customer payments) by location, which is helpful if you have multiple store locations or do most of your business online and want to categorize by locations

- Attach files (documents, images e-signatures, etc.) to transactions from a mobile device or desktop computer

- All transactions with your bank update each night automatically and are immediately available to view; you can even edit them directly if there is a problem

- The Management Reports tool allows the user to build a presentation of financial reports to show to investors, customers or other stakeholders

- The ‘Audit Log’ allows the user to track any changes made to transactions over time, not unlike ‘Audit Trail’ in other forms of QuickBooks

- Create budgets for the fiscal year

- Can allow unlimited users to view reports, but only a limited number can edit/change

- Much more

How much is QuickBooks?

When you first sign up for QuickBooks Online, there are a lot of different pricing plans and options to choose from. Currently, Intuit lets new users pick between trying out QuickBooks Online for free for 30 days, or buying immediately, but saving 50% for the first six months.

From there, business and restaurant owners have four pricing plans to choose from, each offering different features and its own monthly price.

The first and least expensive plan ($10/mo) is designed for self-employed, independent contractors. It has only the very basic accounting features of QuickBooks, including income tracking, expense organization, tax deduction assistance and the ability to send invoices.

One feature unique to this plan is to track miles via the GPS on a mobile device. It doesn’t, however, allow the user to send estimates to potential clients.

The most budget-friendly business plan, Simple Start, costs $15/mo and includes all of the features of the self-employed plan (minus mileage tracking), but allows companies also to send estimates and track their sales tax.

Following in order of price, the Essentials plan comes in next at $30/mo. This plan adds bill management and allows for multiple users (up to 3) to access the accounting information.

Lastly, is the QuickBooks Online Pro plan, which is the most attractive package, but also the most expensive at $50/mo. With it, you get all the features in the above pricing plans, an extra two users, time tracking, inventory tracking and 1099 payment tracking.

There are two add-on payroll options: Enhanced Payroll (an additional $25/mo, plus $5/mo per employee) and Full-Service Payroll ($80/mo and the same $5 charge for each employee on the payroll). These are optional.

Overtime, QuickBooks Online is more expensive than the desktop versions. But, the upfront costs are much less. Rather than spending a lot, all at once with the desktop software, the cloud-based platform spreads the cost out with a monthly fee.

Even though you’ll eventually pay more over multiple months, you never have to make a big spend when a new version comes out, as QuickBooks Online is automatically updated.

How to Setup and Use QuickBooks Online

QuickBooks Online is designed to be incredibly user-friendly and intuitive. After all, it wouldn’t be much help to a small business or restaurant owner otherwise.

The very first step is to enter basic company information. QuickBooks even allows you to upload your logo, so it appears on reports, customer invoices and so on.

Next, you can customize sales forms, set up payment terms, list products/services and any other accounting-based information that you want to utilize.

You can also specify how customers will be billed, whether by an invoice/receipt, a monthly or annual billing period, etc. This information will notify QuickBooks Online how to set up your billing statements.

Other pertinent information to upload to your QuickBooks profile is things like vendor/supplier info and statements, customer sales reports, bank and credit card transactional data and more. The more financial data QuickBooks has, the more useful of a tool it will be to you and your business.

From there, you can explore any of the other instruments and begin performing more advanced finance reporting to determine the financial well-being of your company and where to improve.

It is worth mentioning that, at any time, you can upgrade (or cancel) your QuickBooks Online plan. So, if you suddenly find yourself in need of more features, it’s very easy to upgrade programs.

Intuit has a number of tutorials and guides available online and their support staff is available at all times. Thus, even if you do run into a problem or obstacle, help is always on hand to assist you.

How to Use QuickBooks with eHopper POS System?

QuickBooks can be used with your eHopper point of sale software, thereby connecting all of your sales and transaction data, right into your QuickBooks reports.

By integrating your eHopper POS for QuickBooks Online, you’ll greatly enhance productivity and put a stop to wasting all that time manually transferring and inputting data into spreadsheets. Other benefits of using QuickBooks Online with an eHopper POS System are:

- Gain a clear, up-to-the-moment picture of your income vs. expenses to monitor the health of your business in real-time

- Schedule a time to synchronize eHopper data into your QuickBooks reports, so resources or speed aren’t sacrificed during peak times

- Manage inventory, import new products and even send notice to vendors to request resupply

- Produce visual reports/charts through data analytics and financial reporting tools, which make it easier to see negative or positive trends

- Combine sales and other account information from multiple store locations to get an overall view of the company at large

- Access all of this information on the go

Connecting QuickBooks Online with eHopper is simple and can be done in just a few steps. If you don’t already have an Intuit QuickBooks account, you’ll have to pick an appropriate pricing plan for your business that suits its current needs and sign up (remember, you can always upgrade that plan later).

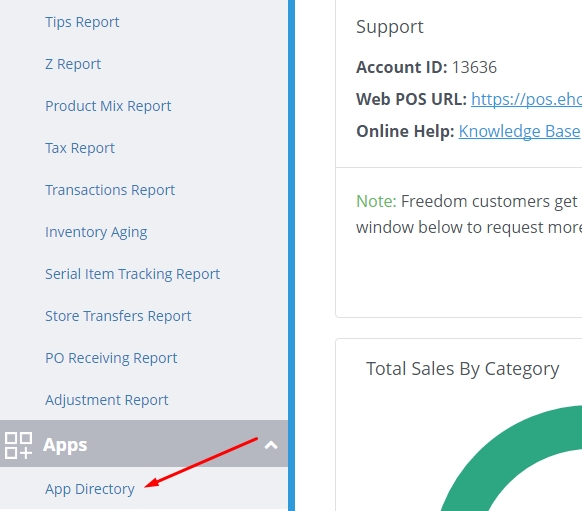

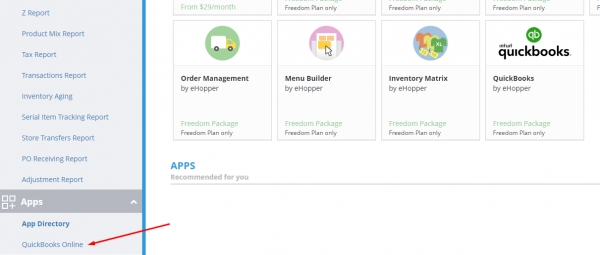

Once you have a QuickBooks Online account, log in to your eHopper Back Office account and access the ‘Apps’ tab through the navigation menu. Inside this menu, you’ll find the “Apps Directory,’ which lets you see all the possible add-ons you can integrate your eHopper POS system with.

eHopper App Directory

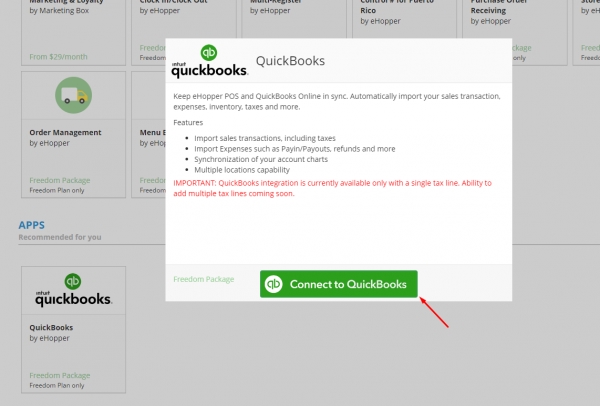

Find the QuickBooks app and install it on your system.

Connect to QuickBooks

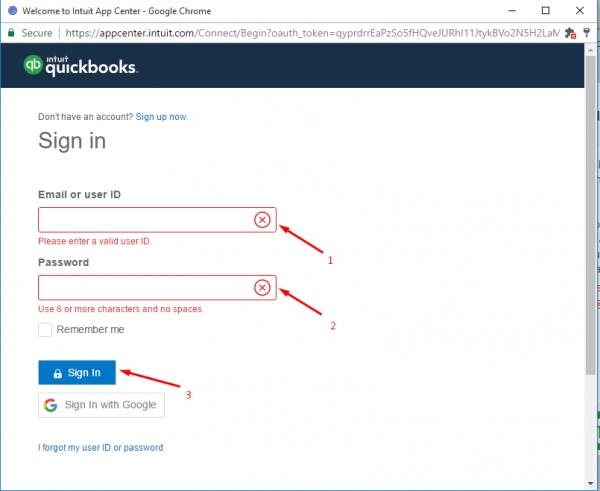

After the app installs, you’ll be prompted to sign into your Intuit QuickBooks account.

QuickBooks Sign In

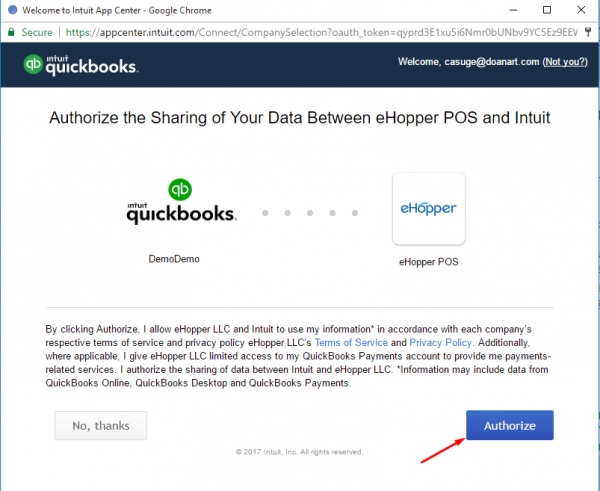

When you enter the info for the first time, the system will ask for you to approve a synchronization of data between your eHopper POS system and QuickBooks Online. In the future, you can schedule these synchronizations to take place at a time that is convenient for you and your business.

Authorize the Sharing of Your Data

At the conclusion of this synchronization, simply open the QuickBooks app through your Back Office Dashboard.

QuickBooks Online App

Thanks to the synchronization, much of your information will already be inputted into QuickBooks, but there may be some additional details and settings you need to manage manually.

Then, it is up to you to explore the different options and possibilities available with an eHopper POS system integrated with QuickBooks Online.

Conclusions

Accounting is a paramount component to successfully running a business or restaurant. As such, it isn’t something that any company can afford to get wrong, especially a small, start-up business or restaurant with limited resources and budget.

It can also be very time consuming without the right tools at your disposal. Company owners can quickly find themselves spending far too much time inputting numbers into spreadsheets, triple-checking inventory or pouring over vendor statements, instead of doing what matters — running their business!

That’s why intuitive accounting tools like QuickBooks Online exist. They eliminate many of the would-be headaches, while also ensuring that all your accounting is duly and accurately maintained.

By integrating this tool with an eHopper POS System, you’ll achieve an unmatched edge in monitoring the financial health and status of your business, choosing the right future investments, generating more revenue and profits and much, much more.

Automate your sales process with eHopper POS QuickBooks Integration. Get started with eHopper today!

Leave a Reply

Want to join the discussion?Feel free to contribute!