How to Manage Cash Flow Effectively with your POS

Cash flow management is integral to any small business that wants to grow. With effective cash flow management provided by a POS (Point-of-Sale) system, your small business will not only save time, but it will also be able to identify the trends that make your small business successful.

Once you’ve incorporated the right POS system, it’s much easier to grow your small business, allowing the POS to keep track of day-to-day expenses and income.

If you want your business to grow faster and more efficiently, the perfect POS system is a tool you must use.

These systems are vital to the survival and growth of your business in today’s economic climate.

It is possible for any business, no matter how small, to take advantage of the data and other benefits a small business POS can provide.

Profit and Cash Flow – Can You Tell the Difference?

These two terms are used in everyday business. Sometimes they are used to describe the same thing, and it’s not incorrect to do so.

However, “cash flow” is an often-misunderstood term.

It doesn’t just mean the amount of cash coming in, the amount of profit available, or the expenses going out.

“Cash flow” is, essentially, a process used to describe how much cash you have on hand at any given time.

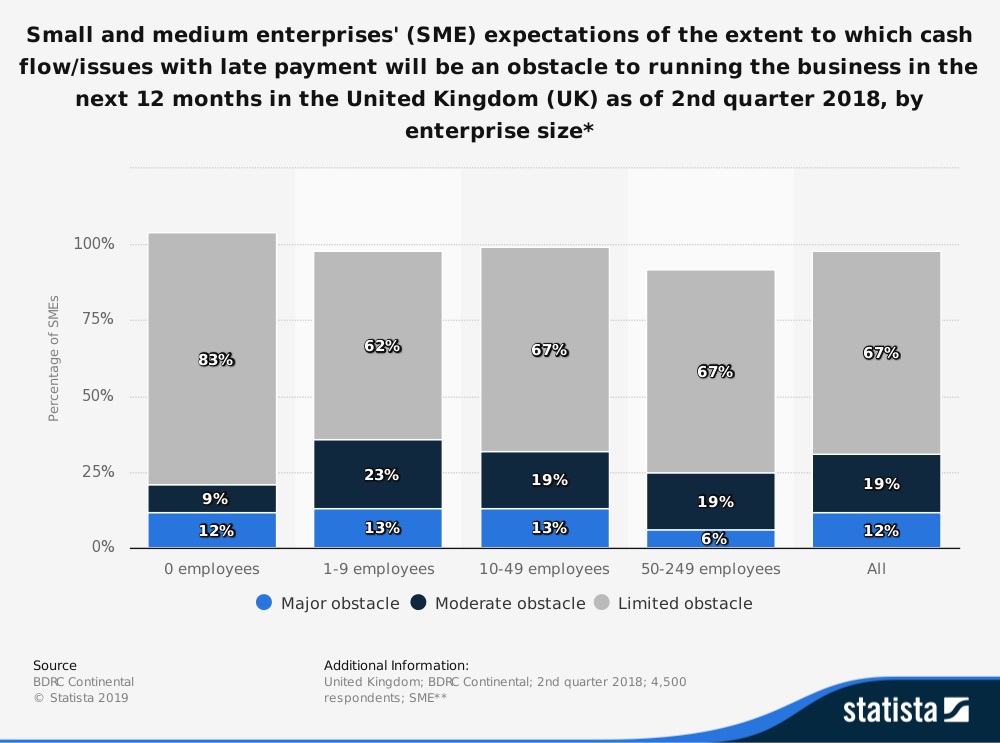

Cash flow management is a huge concern for all businesses.

This allows you to manage your business expenses and growth over the long term, using projections.

The more accurate your data is, the better your cash flow projections will be.

Why do you need these predictions?

As you go through the average business cycles, month-to-month or year-to-year, you may encounter times when you are short of cash.

You may also encounter periods where you have a surplus.

If you can accurately predict out far enough, you may even be able to make long-term strategies that deal with periods of consistent shortages as is the case with seasonal businesses.

Cash flow is much more important to keep track of than just profit. Cash flow management lets you prepare for the future.

Profit alone shows you a definite end but not the variables that go into that number or how it might change with a few adjustments.

Expanding Your Business and Cash Flow Challenges

Growing businesses and new businesses must keep a closer eye on their finances than those just towing the line.

If you are planning on increasing production, putting in new equipment, etc. it behooves you to know the benefits so that you can make the most of your financing options.

Cash flow has as much to do with paying what you owe as it does with measuring your income.

Your projections should offer a complete picture of when your bills are due if you will have enough to pay them, the benefits of better financing or credit options, and even when you may need to apply for a loan if your projected income is short.

That’s a lot to keep track of using a traditional bookkeeping system- whether on paper, software, or online like Quickbooks without POS integration.

This is where a POS can step in and help.

If you have the information that a POS provides handy, it may even be possible to secure better credit terms with your suppliers if your income falls short- or is projected to.

How a POS Can Track Revenue, Expenses, and Profits

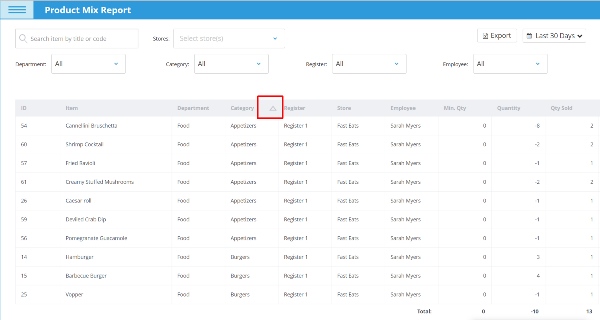

A POS tracks every metric your small business has that can be tracked.

This starts with basic inventory and ends with how much you have sold in a particular shift.

With a quality POS, these sales numbers are then broken down into expenses and profit per unit, per register, or even per hour.

With the right data, it’s easy to see your best sellers and your best sales people.

With proper set-up, a POS can even help a small business identify their key customers and keep track of when credit payments are due if credit is given.

In all cases, a POS can be used to see what is being sold, how it is sold, what method of payment is used, and when it is sold.

At the end of every shift, day, or month it can generate a report to show all of these figures automatically.

This saves time and labor.

Nothing needs to be entered manually after the initial inventory setup.

This kind of automation will make any small business more efficient right away- that effect will only compound in the long term as the system gathers more data.

Why a POS is Better than Any Cash Flow Management Alternative

The only alternative to a Point-of-Sale System is the old-fashioned, written cash flow statement.

This isn’t ideal for a multitude of reasons.

For one, it wastes time.

Today, when a POS is an inexpensive and possibly free thing for a small business to have on their side, there is no reason to keep your cash flow statement on paper.

This creates unnecessary work for anyone involved in it.

Further, it will always be “behind” compared to a POS.

It is also far more likely to be inaccurate. If even one line is entered incorrectly, it can throw off a whole month’s worth of work.

That is not the kind of mess you want to spend your time fixing.

Conversely, with a digital POS, even a small business can correct a month’s worth of statements with just a few types changes.

The system itself will do the bulk of the work automatically.

The Right Tools to Measure Cash Flow and Profit

By now, you may have decided to upgrade to a point of sale system.

If you already have a POS, you may be wondering how to make the most of it. The following features should be available in every worthwhile small business POS.

Industry-Specific Features

Before you consider anything else, look at an industry-specific POS. If your small business is a restaurant, salon, or happen to be in the agriculture industry, there are easy to set up systems built just for your industry.

Especially if you are new to using a POS, these can be a real time saver.

If you happen to have a general retail-type business then just about any POS that is available to small businesses and within your budget could apply.

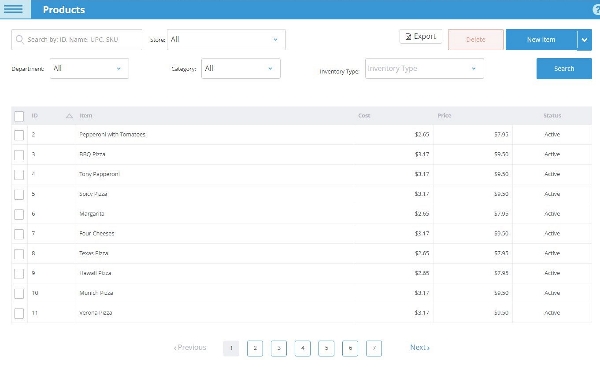

Inventory Tracking

Keeping track of inventory is a given.

Your POS should be capable of this and if it’s not- skip to the next candidate on your list.

To track cash flow effectively, you need to know how much merchandise you have on hand and how that translates to supplies and receivables.

Your POS should be capable of keeping track of inventory.

Customer Metrics

How often do your customers come back? Do they visit once a week? Twice a year?

What is their preferred payment method?

Customer metrics allow you to keep track of how many customers are likely to become repeat business.

Automated Purchases

This may not be a standard feature in many POS systems yet, but it should be.

Automated purchasing features authorize a POS to send an order for a particular item to a supplier when your stock or item inventory has reached a specific threshold.

This can help businesses maintain a constant supply of favorite products or necessary materials and minimize issues caused by an oversight.

Mobility

Mobility in a POS means that you can access your metrics and data from just about anywhere.

This may only mean allowing you to view reports from a mobile device or authorized desktop but the ability to track your business no matter where you are can be invaluable to some.

Overall Cash Flow and Analytics

Analytics, like cash flow, are how you know what’s going on in your business. These are the numbers you need to make informed decisions.

Specialized reports, offered by some POS systems, can help you interpret this data.

Incredible Support

This cannot be understated.

If you are in the market for a small business POS, it needs to have a support team backing it up that you can actually get a hold of.

If something malfunctions or an update freezes your systems, being able to get back on track (and online) swiftly is paramount to your ability to make sales.

Needless to say, test the support system of the POS you choose before you need it.

Employee Tracking

Keeping track of your staff can make a huge difference.

Not only does it show who makes how many sales, but a POS that tracks employee performance can reveal significant differences in who actually does what when it comes to inventory management, sales, and overall customer service.

Small Business Success Comes Down to Cash Flow Management

Saving time and resources are two things a POS excels at beyond basic cash flow management.

Increases in efficiency are necessary as a business grows.

With the right features, a POS can help a company expand faster than it could without one.

Better, it allows any small business owner to become a more efficient manager of their limited time and resources.

If you need a pos system that can properly manage your cash flow, it’s time to take the eHopper test drive today!

Sign up for eHopper POS now, risk free, and enjoy proper cash flow management with a fully integrated point of sale solution.

Leave a Reply

Want to join the discussion?Feel free to contribute!