Best Payment Processors in 2024 [Updated: Guide to Choose a Payment Processor]

In this guide, you will find the best payment processors in 2024, including Fiserv, Nuvei, TSYS, Global Payments, Bank of America, NAB, and more.

Nowadays, offering and accepting credit cards as a payment option for customers is a must. However, it can be difficult to choose a payment processor, as there are a lot of choices in the market.

In this best payment processors guide, we would like to cover some of the companies we happen to work with and recommend. Please note that this post constitutes our opinion only and may be differ from others 🙂

1. What are payment processors what do they do?

Before we jump to the list of best payment processors for small business, let’s define: What are payment processors what do they do.

A payment processor is the company that handles the credit card and debit card transactions for a business. They authorize and confirm customer transactions, acting as the mediator between the merchant and the relevant financial institutions.

Payment processors handle credit card and debit card transactions

More specifically, they communicate information from your customer’s credit card to both yours and your customer’s bank. If there are enough funds in the customer’s bank and their card is valid, the processor verifies the transaction and the payment goes through.

The payment processor then facilitates the transfer of funds to your account, ensuring that you get paid in a timely manner. Many payment processors also provide additional value added services, such as security, PCI compliance, equipment, and support.

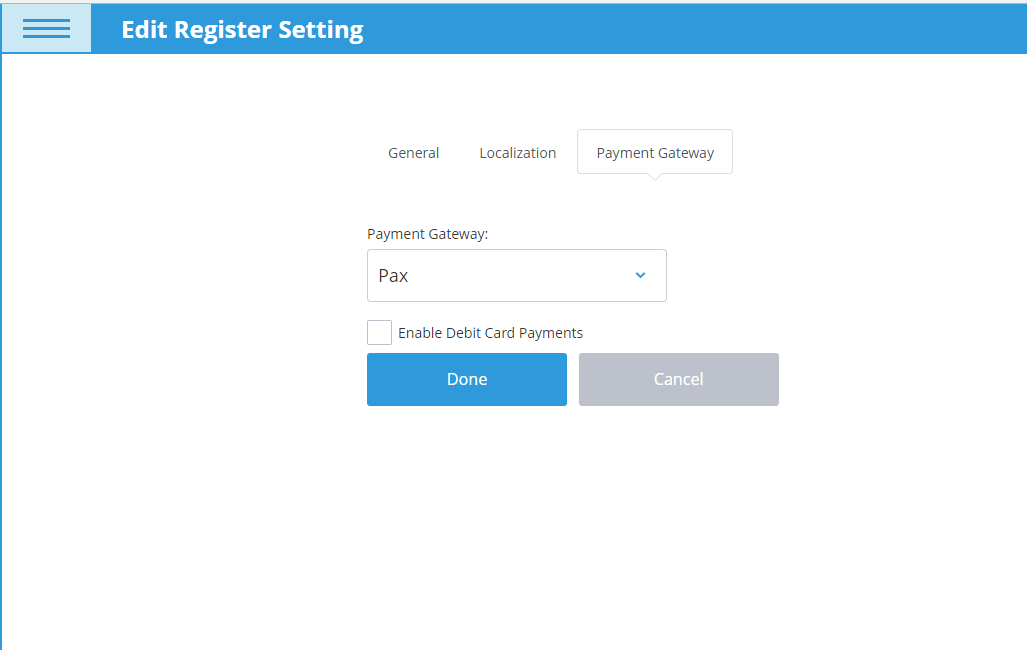

Payment processing solutions can also be integrated with a point of sale system, such as eHopper. When this occurs, it enables businesses to keep all of their payment and transactional data in one centralized location, allowing you to dramatically save time, reduce error, and cut costs.

2. How does payment processing work?

Now that we have defined what are payment processors what do they do, we will review how payment processing works. First let’s define a few terms:

What is a Merchant Account?

The first step in the process of getting started with payment processing is to find and obtain a merchant account. A merchant account is an account set up through a credit processing company or a bank which allows you to accept and process card payments.

Without a merchant account, you will not be able to accept payments by any of the major credit card brands.

What is an Issuer?

An Issuer is the Issuing bank or financial institution that extends credit to a cardholder as a transaction takes place, issuing their credit or debit card, or other digital payment method. The financial institution then proceeds to bills the cardholder for the purchase.

What is an Acquirer?

An acquirer is an acquiring bank or financial institution that facilitates your merchant account, by processing and settling all approved transactions.

Now that we have defined the key terms, let’s delve into how payment processing works.

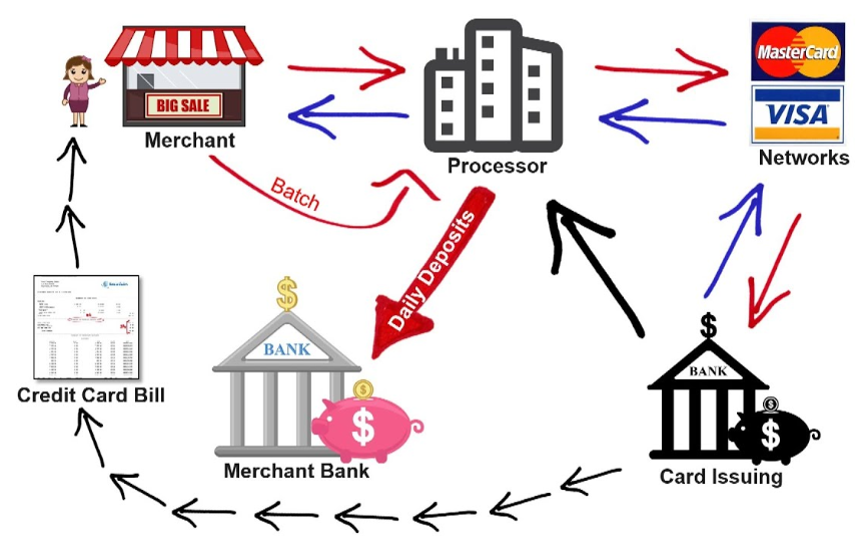

In the first step of the payment processing process, called Authorization, a cardholder chooses an item to purchase from you, the merchant, either in-person or online. During check out, the cardholder then will either swipe the card, use a contactless payment method, or have their payment information manually entered at the POS or online payment gateway.

The cardholder’s payment information is then quickly transferred to the payment processor, which evaluates the transaction’s validity by communicating with both the issuing and acquiring banks via the credit card network (Visa, MasterCard, etc).

The issuing bank will then either approve or decline the transaction, based on the card data it receives, through an authorization code. This code will then be sent back through the credit card network and merchant acquirer to the credit card terminal/online gateway, and finally to the point of sale or online ordering system, which will allow for the completion of the purchase. This entire process occurs in just seconds.

In the second step, called Clearing, the transaction data from the card payment that took place is sent from the acquiring bank to the issuing bank, so it can be posted on the customer’s monthly credit card statement.

Finally, in the third step, called Settlement, the acquiring bank ensures funds from the credit card transaction are paid and collected into your merchant account.

How Payment Processing Works

3. Do I need a payment processor?

Yes, if you want to accept credit or debit cards, having a payment processor is a must. The entire process outlined above cannot take place without a payment processor facilitating and managing it.

As a result, there will be no way for you to receive funds from card transactions, eliminating it as a payment option for your customers. This will likely largely limit the number of customers who choose to purchase from you, as well as the revenue you take in for your business.

In short, if you want your business to be successful, having a payment processor is 100 percent necessary.

4. What is the difference between a payment gateway and a payment processor?

A payment gateway is different from a payment processor in that it is the mediator between the payment processor and credit card companies, such as Visa and MasterCard, managing the technical aspect of transferring cardholder data.

Essentially, it connects your customer’s issuing bank to your merchant/payment processing account, so that you are able to receive the funds. So, even if you have a payment processor, without finding the best payment gateway, or a payment gateway solution, you would not be able to receive your customers’ card payments.

Payment Processors We Recommend

Below you will find a list of payment processors we recommend, in alphabetical order, along with some basic information about each.

Bank of America

Bank of America is a multinational investment bank and financial services holding company that was founded in 1998 and is headquartered in Charlotte, North Carolina.

It is one of the world’s largest financial institutions, providing financial and risk management products and services related to banking, investing, asset management and more.

Elavon

Elavon is headquartered in Atlanta, Georgia, offering merchant processing in more than 30 countries.

It provides payments on the go, online, or in person, loyalty programs, payment gateways, security and PCI compliance, and has earned an A+ rating from the Better Business Bureau in the U.S. and Canada.

Evo Payments

Evo Payments was founded in 1989 and is based in Atlanta, Georgia. The company is active in 50 markets and 150+ currencies around the world, making it one of the largest fully integrated merchant acquirers and payment processors in the world.

EVO provides processing solutions for businesses of all types and sizes and offers such services as merchant acquiring, gateway services, POS terminals, marketing services, and fraud prevention.

Fiserv

Established in 1984 and public by 1986, Fiserv is focused on the financial services industry. They are a global leader in payments and fintech, serving thousands of financial institutions and millions of businesses in more than 100 countries. Fiveserve expanded even further in 2019 after it purchased First Data.

The solutions the company offers include payments, processing services, risk & compliance management, customer management, and more.

Global Payments

Headquartered in Atlanta, founded in 1967, Global Payments provides financial technology services around the world.

It offers such services as payments, gift and loyalty, payroll, reporting, and business loans.

North American Bank (NAB)

North American Bank (NAB) was founded in 1992 and is headquartered in Troy, Michigan. It is a payments technology company that offers solutions for credit, debit, EBT, check conversion and guarantee, ecommerce, gift & loyalty cards, and more.

Nuvei Payments

Nuvei Payments a public company established in Canada in 2003, covering markets in the US, Canada, and Europe. It is Canada’s largest private and non-bank payment processor.

Nuvei offers electronic payment processing and merchant services for both in-store and mobile payments, as well as integrated fraud detection, PCI compliance, currency conversion, chargeback management, unified reporting, and much more.

Nuvei supports over 450 local and alternative payment methods and over 150 currencies, with connections to over 200 global acquiring partners.

TSYS

Founded in 1983 and headquartered in Columbus, Georgia, TSYS provides payment processing services, merchant services and related payment services. It also provides reloadable prepaid debit cards and payroll cards.

For online ordering payments, there are other alternatives to using in-store payment processors. eHopper supports the below best online payment processors:

PayPal

Founded in 1998 and headquartered in San Jose, California, PayPal supports online payments in the majority of countries around the world. It offers both web and in person payments, online invoicing, digital marketing, business loans, and more.

Stripe

Founded in 2010, Stripe is an Irish-American financial services and software company that is dual-headquartered in San Francisco, California and Dublin, Ireland.

Stripe provides a payment platform for eCommerce websites and mobile applications, as well as applications to manage revenue, prevent fraud, and expand internationally, and cloud-based infrastructure.

Conclusion and Next Steps

As showcased in this guide, having a payment processor to accept credit card payments is critical in order to accept credit card payments for your business. Without a payment processor facilitating the transaction process, there would be no way for you to receive the funds into your bank account from card transactions.

Because there are so many options out there for payment processors, we hope the best payment processors we recommended in this guide will help make your decision easier. These processors work with eHopper to provide credit card integration through our point of sale solution.

eHopper also offers credit card processing via an online ordering system, through PayPal and Stripe.

Get started with eHopper today to accept credit card payments for your business!