Guide to EBT and Food Stamps for Small Business Retailers

The Supplemental Nutrition Assistance Program (SNAP), formerly the Food Stamp Program offer food stamps and EBT to those in need.

These efforts are designed to help low and no-income families receive financial assistance to pay for basic groceries and nutritional needs.

They are strictly designed for food products, so non-food products like soaps, paper products, and other household supplies are not purchasable with food stamps.

According to food stamp statistics, 14% of the US population leverages this federal aid to help meet the financial demands of their nutritional needs.

This translates to over 41 million people in the country.

If you are a small business retailer that could potentially accept EBT payments, then it is important to know how and what type of retail POS software you need.

Otherwise, you could be missing out on this sizeable portion of consumers.

How Can I Accept EBT And Food Stamps In My Store?

To accept EBT payments and food stamps, you have to sell food that is for home cooking and consumption.

A restaurant doesn’t qualify under the Supplemental Nutrition Assistance Program because the food sold is not eaten or prepared at home but the restaurant or dining establishment.

In addition to selling food and groceries for home cooking and meal preparation, a store must also meet one of two criteria:

- Have at least three different qualifying foods of each of the staple food groups (meat/poultry/fish, bread/grains, vegetables/fruits, dairy) regularly available for purchase

- 50% of all retail sales are from the sale of eligible staple foods.

In other words, you have to have an extensive selection of grocery-type food items spanning various food groups OR make most of your money in food-related sales. The latter distinction is important for specialty food stores and grocers.

For example, a seafood market likely doesn’t qualify for the first criteria because they sell predominantly fish, thereby barring them from having three food products from each group.

But, the majority of their retail sales are for the purchase of fish, a staple food item, which means they qualify for accepting EBT payments and food stamps under the second criteria.

Applying for a Permit to Receive EBT Cards and Food Stamps

If you are eligible as a retailer that could accept food assistance vouchers, like food stamps or EBT transactions, then you have to apply for a permit through the Food and Nutrition Service (FNS).

You can receive an application for a permit by mail, after calling the FNS hotline and requesting one.

Alternatively, you can go online and use the online store application form for accepting EBT payments.

The application process requires a store to submit a number of documents with their application. Including:

- Social Security information for you and any other business owners, partners or primary shareholders

- A copy of your driver’s license or another form of photo identification

- A copy of your business’ current license, such as a sales tax permit or other documentation

The approval process can take up to 45 days before a retail business is approved or denied for a permit.

There is no charge for applying for a food stamp permit. However, if your application is declined, you have to wait half a calendar year before applying again.

What Products Do EBT Benefits Buy?

EBT payments can be made on items that fall into the essential staple food groups: breads and cereals; fruits and vegetables; meats, fish and poultry; dairy products; and seeds and plants which produce food for a household to eat.

Conversely, this federal aid cannot be used for paper goods and hygiene/grooming items, pet food, beer/wine/liquor, vitamins or food that will be eaten on premise.

There are also a number of articles that are currently eligible for SNAP benefits, but whose eligibility status has been questioned before.

For example, food items like soft drinks, candy, ice cream, energy drinks and other “junk food” items are eligible, but many people question their nutritional value and thus their inclusion in an aid program centered around bringing proper nutrition to less financially stable individuals.

Other special occasion items, such as pumpkins on Halloween and birthday cakes, are also eligible, as long as the item is edible.

Decorative items, like a Christmas tree, on the other hand, aren’t eligible for SNAP assistance.

What Does EBT Cost You?

For some businesses, accepting EBT payments costs nothing.

Unfortunately, in this case, “some” means a small number of business types.

This list includes the following:

- Farmers’ markets

- Military commissaries

- Not-for-profit food cooperatives

- Community-focused meal service programs

These types of organizations can benefit from the state-supplied point of sale machines with the necessary software to accept EBT transactions.

For businesses that don’t fall into any of the above categories, it is up to them to purchase the necessary equipment to handle EBT payments.

This means they have to find and invest in a POS system capable of handling SNAP benefit payments.

How Does EBT Work?

EBT payments are processed a lot like your typical debit or credit card transaction.

EBT program participants receive a card that can be swiped at qualified food retailers and follow the same procedures like most other card-based transactions.

However, to actually accept and review EBT payments, you need the proper point of sale software that can handle these exchanges.

This software will ensure that the items in the transaction are food items and thereby eligible for SNAP benefits.

With the proper point of sale software, all of the purchases made with an EBT card are totaled at the end of the day and kept separate from other transaction totals.

This makes it easier to maintain accounts distinct from one another and ensures comfortable reporting to your state’s EBT vendor.

From there, EBT payments can be transferred to your store’s bank account, just like a typical card-based exchange.

What Point of Sale Software Supports EBT Payments?

Without the correct POS system in place, you won’t be able to accept EBT Payments

If your business meets one of the two criteria for becoming a retailer that accepts EBT payments, then your next step is to find and invest in a point of sale software solution that supports these types of federal aid payments.

Without the correct POS system in place, you won’t be able to accept these exchanges properly.

Considering how many people use and rely on EBT benefits, failing to have the necessary equipment to receive food stamps and other SNAP-issued food vouchers could be negatively impactful for business.

Not only does it mean turning away potential business that is trying to use their EBT card, but it is also damaging to the overall customer experience.

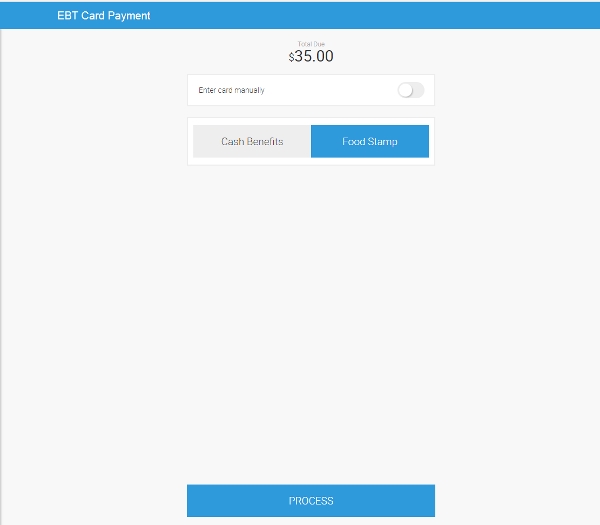

eHopper POS provides the capability to process EBT payments. Setting up your mobile POS software to receive food stamps and other food assistance benefits is as easy as downloading the EBT Card App in the eHopper back office. Get started with eHopper today!

Once you go through the proper registration settings, completing EBT transactions is simple. Any EBT-eligible food items can be designated to be paid with the food assistance perks, while non-eligible items can be paid for separately, using whatever means the customer would like. This separation is done by the cashier right in the interface of the POS system.

Maintaining Your Permit To Receive SNAP Food Stamps

Once you’ve gone through the steps to acquire a permit to accept EBT payments and set up your POS system to accept such exchanges, it is important to know some of the rules and guidelines you need to adhere to ensure that you don’t lose your permit. As damaging as it is to not accept EBT cards at all, it is arguably even more damaging to take these payments and then abruptly stop because you’ve lost your permit as an EBT retailer.

Some of the rules and guidelines that SNAP retail participants have to follow are:

- Only accepting food stamps for eligible food items

- Never issuing cash refunds for food bought with SNAP benefits

- Payments have to be made on the spot; retailers can’t allow food stamps to be used on credit

- Items purchased with an EBT card are exempt from any additional sales tax charge

- Never accepting a SNAP transaction unless the customer has both their EBT card and PIN number

There are a number of other rules and regulations that retailers have to follow to maintain a good standing with this federal aid program. The above list hits all of the major rules, but for a complete list, you should consult your state’s FNS (Food and Nutrition Service) office.

Conclusions

If you are a retail business that does the majority of its sales in food items, there’s a high likelihood that you could qualify for a permit to accept EBT and food stamps from SNAP participants. Given the sizeable percentage of the US population that relies on this federal food assistance program, having the ability to receive EBT payments is very advantageous.

Not only will you be able to receive payments made with food stamps and other SNAP benefits, but your business will also benefit from having an enhanced customer experience.

Leave a Reply

Want to join the discussion?Feel free to contribute!