How to Choose the Best Credit Card Processing for A Small Business

Cash flow is the lifeblood of a small business. You’ve created a company, gained customers, marketed your products successfully and now it is time to see some money rolling in. But, the work isn’t over; you still have to find a solution for credit card processing for a small business.

Now, you may be saying to yourself, “my bank processes my credit card transactions.” This is the path that a lot of small business owners take, but it isn’t the best one. Banks tend to charge a high fee for their credit card processing service. When you look elsewhere for credit card processing for a small business, it can be challenging to separate the quality and credible companies from the phonies that make way-too-good-to-be-true claims about their price plans and services.

To help you choose the best credit card processing for a small business, we’ve created this checklist of things to look for, questions to ask and knowledge to equip yourself with as you hunt for a service to handle these transactions.

1.) How Do I start Accepting Credit Cards For My Business?

To start accepting credit cards at your small business, you have to find a credit card processing service. Again, many banks will do this for you, but some other companies may offer a more reasonable package for your small business. The difficult task is knowing which service provider is going to be right for your company. This is an important distinction because there’s good and even excellent credit processing services (and heaps of bad), but there isn’t one service that offers the best credit processing for a small business because every company is different and has unique needs.

For example, if you’re an inexperienced business owner or lack the financial know-how to grasp some of the terms and features that credit processing involves, you probably want to choose a service that’s very invested in their customer service. When you run into an obstacle, they’ll be able to walk you through the problem successfully. On the other hand, if you rarely rely on customer service, this isn’t much of a worry.

Small business owners also need to pay close attention to the rules and fees associated with each credit card processing service. For example, some services charge a small fee for every transaction. That’s why a lot of stores and small businesses choose to have a $5 minimum (or more) when it comes to customers making credit card purchases. You have to be wary of this fee if you have a lot of low-priced items and customers make a lot of small purchases.

Similarly, some credit processing for small business services have a minimum monthly threshold. If you don’t reach that sales threshold at the end of the month, there could be a charge. Thus, if your month-to-month sales aren’t particularly high, you should avoid these types of service providers or choose one with a threshold that is well below your monthly sales numbers.

2.) How Does A Credit Card Processing Work?

You don’t need a detailed understanding of how credit card processing works, but you should have a general idea of the various steps in the process because this can help explain why individual providers assess the fees that they do and how you can better prevent your small business from incurring said fees.

When you take a moment to think about credit card processing, it is kind of surprising. At the moment that you or a customer swipes his or her card at the store, the card information and order data are sent through some different channels.

First, the credit card terminal transmits the info to your credit card processor, who then communicates it to the credit card network where the issuing bank/creditor can approve the transaction. The bank/creditor then “replies” with their authorization and that information travels through the same series back to the terminal. Again, this happens in a split second.

Fees for credit card processing can occur at any step of this process. Your processing service, as mentioned before, may charge a small fee for each transaction, which helps them cover their costs of being the middleman between the bank and your terminal. If the transaction is unsuccessful, the bank may charge the cardholder, and your small business may even see a small fee. These are all significant concerns for small business owners looking to offer credit card processing to its customers. No one likes paying fees!

3.) What Features To Look For When Choosing a Payment Processing Company?

The very first thing you want to be sure of is that your credit card processing service is compliant with the new chip card security, also known as EMV. This is especially critical today because all banks and credit card companies issuing new cards use this chip technology. Because the chip is more secure than older cards that only have the magnetic strips, it gives peace of mind to both you and your customers when completing credit/debit card transactions.

Past EMV compliance, there are some other features to consider when choosing a credit processing for a small business service.

NFC and mobile payments: More and more people are using their mobile devices to pay. Mobile payment options are linked to a person’s credit card, which adds another link in the credit card processing chain. Your credit processing provider should be able to handle these types of transactions, whether they are coming from Google Wallet, Apple Pay, Samsung Pay or another app, because they are becoming increasingly popular.

Your credit processing provider should be able to process NFC and mobile payments

Security and theft prevention: This may go without saying, but your credit processing service should detail their security protocols that help prevent suspicious transactions from occurring. You want your business and its customers to be protected in any way possible.

PCI compliance: PCI is the standard used for connecting a computer to other equipment and peripherals. Regarding credit processing, it means ensuring that your service provider’s card reader (if they supply one) and software meshes with your existing point of sale system. This is very important because POS systems today are different than traditional methods and use mobile tablets and other devices to complete transactions. Whatever retail POS software your business implements, your credit card processing unit has to be able to connect to it.

Supports both credit card and debit/pin pad transactions: This is another feature that may seem obvious, but you want your processor to do both transactions from the same system. In other words, you don’t want to have multiple readers for various types of transactions. This is confusing for the customer, creates clutter on your counter and is incredibly inefficient.

Payment flexibility: Payment flexibility means some different things. As previously mentioned, your credit card processing for small business service should have the flexibility to enable you to accept all types of transactions from the same unit. It should also allow you to make changes to card transactions, manually enter amounts and other actions that will help keep your busy line moving and getting customers out the door.

Offsite data storage: Credit card processing requires a lot of personal information. During those moments that it takes to handle a credit card or debit card transaction, the customer’s primary information, bank account numbers and other data is being tossed around. You don’t want that information stored on your system because if you have a data breach, you’re liable for their data and card numbers being leaked. The data from your transactions should be housed by the credit card processing service you’ve chosen, which takes the liability out of your hands.

Human error: You hire the best employees possible to manage your registers and complete customer transactions, but human error is natural. Everyone makes mistakes. Your credit card processing service should have some protocols in place to catch and remedy these errors. For example, a cashier scans a customer’s item, rings up a sale, prints a receipt, but never actually collects payment. These protocols can also help protect you from theft and employee fraud (employees pocketing money from transactions).

Prevent chargebacks: By storing receipts and digital signatures in the system, it is easier to retrieve data from past transactions. This makes it easier to prevent chargebacks and, if a chargeback does occur, the process should be much more streamlined compared to filing paper receipts.

Reporting and reconciliation: Integrating your credit card processing service into your existing POS system will allow you to leverage software features of that system. For example, if your mobile POS system offers custom reports like eHopper does, then it is essential that your credit card processing service allows you to use those reports in tandem. This vastly cuts down on how much time you need to spend on reconciliation.

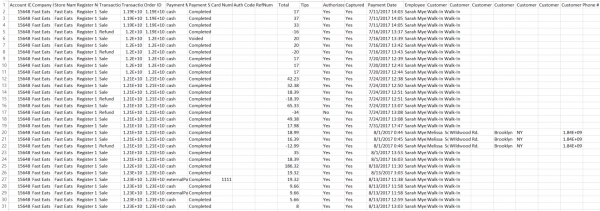

View and analyze all payments with transaction report

Customer Support: Whether you use customer support a lot or not, you should check the track record of your credit processing for small business service and make sure that they are okay to deal with. If there are a lot of complaints and a general sense of poor customer service, it may not be worth the few dollars you may be saving by choosing that provider. You also want to look at the customer support hours. Is it 7 days a week or only available on certain days? You want always to be able to reach someone when you need to.

Unlimited Batch History: This type of feature allows you to take a look at your entire history of credit card transactions. Some credit card processing services only let you look at specific frames of time. To get the best insights and a clear idea of how your business is doing and has done in the past, you want unlimited batch history.

4.) Benefits Of Cloud-Based Payment Processing

The cloud may seem ambiguous and strange, but it is providing small businesses with a vast number of advantages. In terms of payment processing, the cloud reduces the overall cost of software, makes it easier (and faster) to access data and transaction histories, makes transactions more quickly than they already were and any information or transactions can be obtained anywhere you have an Internet connection.

The cloud reduces the cost of payment processing because it simplifies the number of steps to complete a transaction. This also hastens the already-fast transaction process. The cloud achieves this because all of the involved parties have immediate access to one another, rather than each being disjointed. Traditional, non-cloud transactions are like a company where every department is separated from one another. Your marketing guy has to walk down to the advertising department to make sure that the two are on the same page. Cloud-based payment processing is putting all involved departments in the same room, so your marketer needs only to ask him an immediate question.

With cloud-based payment processing, your transaction histories are stored on the Internet. If you are on the go or want to check in on the status of your business, you can access that information via an app or website. As long as you have an Internet connection, you can be connected to your business. It’s password protected, so there are no security risks. The immediacy and accessibility of cloud-based software make it a huge advantage for any small business.

Conclusions

As you shop around for the best credit processing for small business services, all of the topics and features discussed in this “checklist” are things that you should bring up to your potential service provider. Again, cash flow is the lifeblood of a small business. To generate that flow and protect it, you need to have credit card processing capabilities.

Choosing the right provider means getting all of the features and tools you need not only to handle credit card payments, but also mobile payments, EMV chip cards and everything else. The best strategy is to draw up a checklist of the features that are most important and crucial to your business’ unique needs.

Then, talk about every item on that list with the credit card processing services you’re interested in. If they don’t offer a feature, you want or can’t give you a good answer, move onto the next. It’s better to spend the time, do your homework and shop around then be locked into an inferior service that doesn’t provide the right amount of value to satisfy your needs.

If you are looking for POS system that supports credit card processing, get started with eHopper POS today, risk free!

Leave a Reply

Want to join the discussion?Feel free to contribute!